OPINION: This article may contain commentary which reflects the author's opinion.

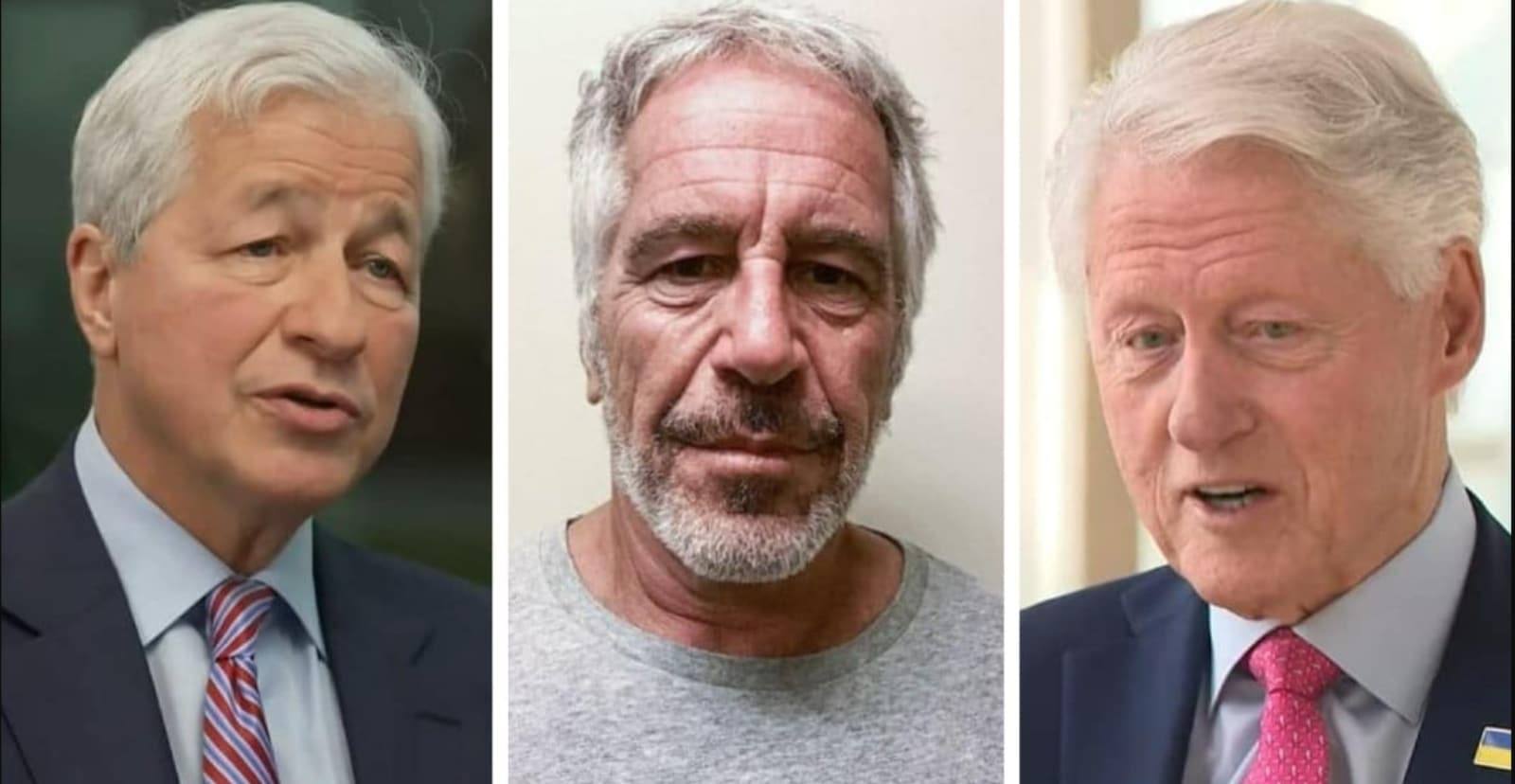

Sources familiar with the matter reveal that JPMorgan Chase & Co. had connections to Jeffrey Epstein that were more extensive than what the bank had publicly acknowledged and lasted for several years beyond the time it terminated the accounts of the convicted sex offender, according to a Friday report.

Insiders told the news outlet that Mary Erdoes, a high-ranking executive who reports to CEO Jamie Dimon, visited Jeffrey Epstein’s residence on Manhattan’s Upper East Side twice, in 2011 and 2013, while Epstein was still a client of JPMorgan Chase & Co.

During this time, the WSJ said, she corresponded with Epstein via numerous emails and talked about potentially splitting fees with him from a charitable fund that the bank was contemplating launching, the insiders revealed.

John Duffy, who oversaw JPMorgan’s U.S. private bank catering to the uber-wealthy, visited Epstein’s townhouse for a meeting in April 2013, the WSJ reported. A month after the meeting, and despite compliance staff’s repeated concerns about Epstein’s unorthodox banking methods, the financial giant renewed an authorization permitting Epstein to borrow money against his accounts.

According to sources, Justin Nelson, a banker who handled Epstein’s accounts at JPMorgan, visited Epstein’s Manhattan residence approximately six times from 2014 to 2017. In addition, he reportedly ventured out to Epstein’s New Mexico ranch in 2016, the report said.

JPMorgan had previously stated that it terminated Epstein’s accounts in 2013. Erdoes, meanwhile, had also remarked via a JPMorgan spokesperson that the only instance she could recall meeting Epstein was when she dismissed him as a client of the bank’s private bank.

Erdoes declined to provide any further comment to the WSJ for its report, the outlet said.

In 2008, Epstein was found guilty of soliciting a minor for prostitution and was obligated to register as a sex offender. He was later arrested in 2019 and was accused of masterminding a scheme to engage in human trafficking and sexual exploitation of underage girls.

The banking institution has denied any knowledge of Epstein’s illegal activities and has taken legal action against its former executive, Jes Staley, claiming that he deceived the bank regarding Epstein’s behavior and reputation. Staley’s legal team has countered that the accusations against him are unfounded.

The latest revelations indicate that even after Epstein’s initial conviction, JPMorgan continued to treat him as a valuable client, disregarding concerns raised by its staff. Furthermore, following the bank’s decision to terminate Epstein’s accounts, its officers continued to hold meetings with him for an extended period, the WSJ reported.

A JPMorgan spokesperson told the news outlet that the amount of engagement with Epstein was not unusual for a private bank client. In addition, the spokesperson claimed that any meetings that took place between Epstein and JPMorgan after 2013 were solely related to other bank clients whom Epstein represented.

Two lawsuits filed against JPMorgan in federal court in Manhattan in late 2022 have once again highlighted the bank’s links to Jeffrey Epstein.

The late financier, who was awaiting trial on sex-trafficking charges, died in a New York jail in 2019 in what the city’s medical examiner determined was a suicide. The lawsuits were filed by a woman who claims to have been sexually abused by Epstein and by the U.S. Virgin Islands, where Epstein’s private island was located. The suits asserted that the bank facilitated the transfer of funds that were used to compensate Epstein’s alleged victims.

“JPMorgan said it isn’t liable for Epstein’s crimes. Through a spokeswoman, lawyers for the Virgin Islands and the Epstein accuser said the public filings in the lawsuits speak for themselves,” the WSJ reported.

JPMorgan has provided documents in response to the two lawsuits, which contain information on the interactions between Epstein and over 20 present and former employees and executives of the bank. Several of these individuals have given sworn statements in depositions, and Dimon, the CEO, is scheduled to do so in May, the outlet noted further.

“Epstein became a JPMorgan client in about 1998, according to documents filed in connection with the lawsuits. Over the years, the bank would come to manage some 55 Epstein-related accounts containing hundreds of millions of dollars, the documents show,” said the WSJ.