OPINION: This article may contain commentary which reflects the author's opinion.

President Joe Biden’s visit to a diner in Raleigh, North Carolina, last week did not go as smoothly as anticipated by his White House team, mainly due to a notable discovery on the menu.

The White House has been trying to promote “Bidenomics” to the public – a collection of economic policies championed by the president and his administration, which they assert have significantly enhanced the well-being of everyday American workers.

But it’s just turning out very well.

“As of November 2023, 62% of consumers relied on their next paycheck to cover their monthly financial outflows, the PYMNTS and LendingClub survey said. These consumers also own nearly 60% of the credit cards in the U.S. Moreover, 80% of paycheck-to-paycheck consumers own at least two credit cards on average,” Fox Business reported in late December.

“The report also said that paycheck-to-paycheck cardholders are more than twice as likely as those not living paycheck-to-paycheck to carry a credit card balance over to the following month. Close to one-third said they reached their credit card limit, an average of $9,200, at least occasionally in the last year,” the outlet reported, citing the data.

In August, The Hill reported on a Lending Club survey that revealed 60 percent of American households were managing their finances on a paycheck-to-paycheck basis, a situation that even affected 45 percent of individuals earning over $100,000 annually.

This stark reality was exemplified in a single photograph highlighted by a Republican state senator in North Carolina during Biden’s visit to a local restaurant, as reported by the UK’s Daily Mail.

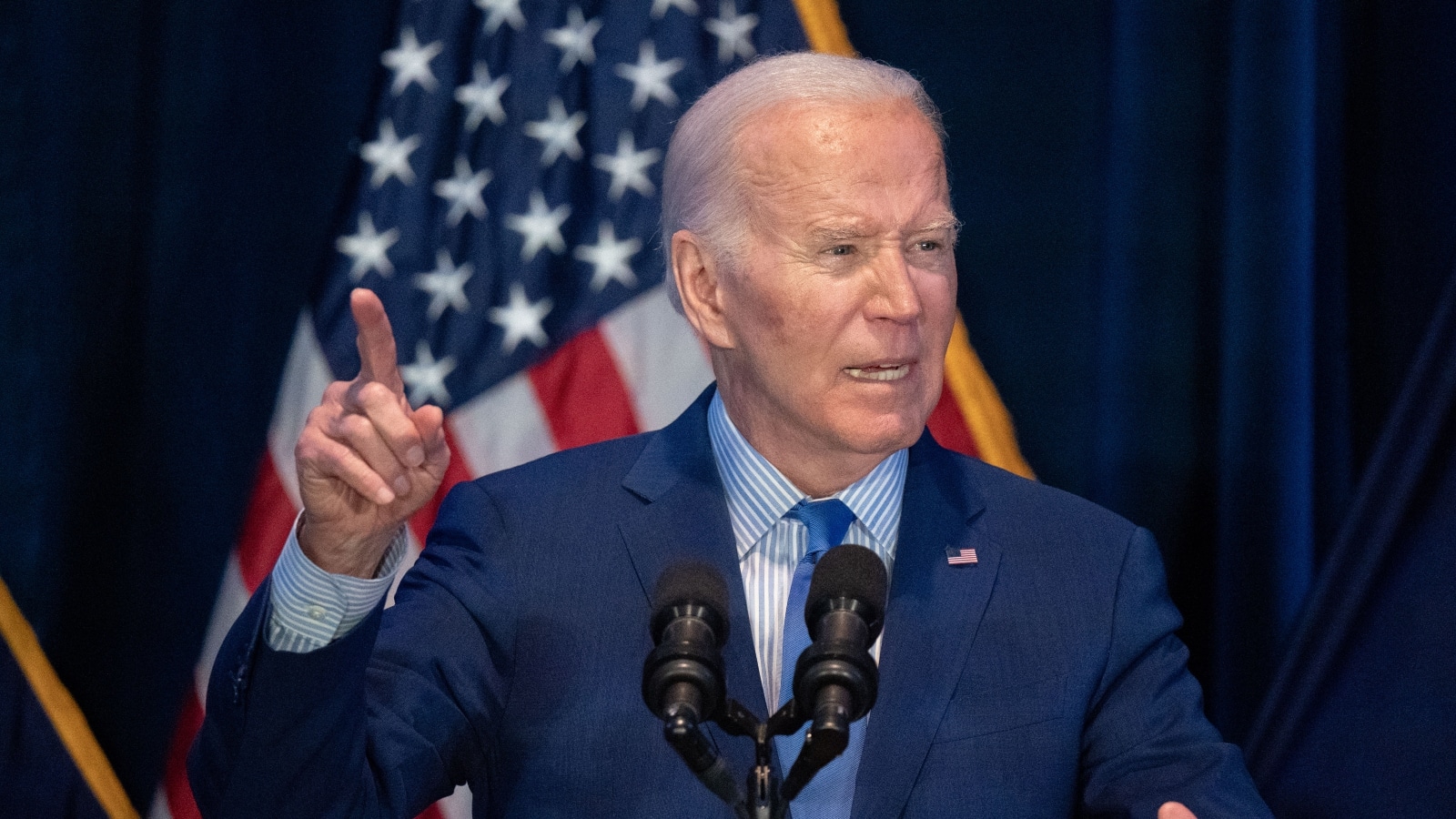

Following President Biden’s address on the importance of expanding broadband access to rural areas, drawing parallels to FDR’s initiatives to electrify the nation, he made an impromptu visit to the Cook Out restaurant in Raleigh. During his visit, he placed an order for a “triple thick” chocolate and vanilla milkshake along with a bacon cheeseburger accompanied by a serving of fries.

Biden made a prior visit to one of the franchise’s establishments in October 2020 during his campaign. State Senate leader Phil Berger shared a side-by-side comparison photo, juxtaposing that earlier visit with a snapshot of the restaurant’s current menu, which clearly displays a substantial price hike for the tray that Biden had ordered.

In the 2020 photo, the menu pictured in the background showed the price of a Cookout tray, which was $5.99 at the time. In contrast, the picture taken Thursday showed an almost identical menu at the same restaurant now but it is now charging $7.69 for the Cookout tray, according to Newsweek.

“Thanks to #Bidenomics, a Cook Out tray costs 28% more than it did three years ago when Biden had his previous photo op,” Berger tweeted.

Thanks to #Bidenomics, a Cook Out tray costs 28% more than it did three years ago when Biden had his previous photo op. #ncpol https://t.co/3zUsO0z5cV pic.twitter.com/Ifn7wrp4Q8

— Senator Berger Press Shop (@SenBergerPress) January 18, 2024

Other X platform users also joined in.

“A $100 grocery shop in 2019 now costs $125.81. #Bidenomics,” one user wrote.

“This is epic,” another tweeted. “Biden did a photo op at the same restaurant he ate at 3 years ago. Today’s menu clearly shows a 28% increase from 3 yrs ago. This hyperinflation was directly caused by Biden’s disastrous policies. Thank you Sen. Berger for noticing and posting this.”

“Celebrating that milkshake costing about 20% more than his last Cook Out visit!!!” wrote another user.

As for the nation’s spiraling credit card debt in the age of Bidenomics, that has risen to $1.08 trillion after wracking up an additional $48 billion during the third quarter of 2023.

“Credit cards can be an important financing option that credit-savvy consumers use to better manage their cash flows, though it’s concerning that many consumers revolved their credit card balances regardless of financial lifestyle,” LendingClub’s Money Expert Alia Dudum told Fox Business. “Credit cards keep many in debt, and cardholders who carry a balance (revolvers) subsidize the rewards earned by those who pay their balance in full every month (transactors).

“Revolvers need better solutions for retiring existing debt and better options for bridging gaps in cash flow,” Dudum added.