OPINION: This article may contain commentary which reflects the author's opinion.

The U.S. Supreme Court has denied former President Donald Trump’s emergency application requesting that it block a Democratic-led House committee from obtaining his tax returns.

“The denial allows Trump’s tax returns to be released to the House Ways and Means Committee, which has been attempting for years to obtain them from the Internal Revenue Service as part of its investigation into the service’s presidential audit program. Tuesday’s order, which was unsigned and included no dissent, vacates a temporary hold Chief Justice John Roberts placed on the documents earlier this month,” Axios reported.

“Trump, who has been fighting for years to block the release of his tax returns, requested the high court weigh in after a federal appeals court also declined one of his requests to block the release of the documents. Lawyers for Trump have argued that the committee does not have a legitimate legislative purpose for the documents and seeks only to publish them. The Department of Justice under the Biden administration argued in a 2021 opinion that the committee’s request was legitimate and the Trump-era Treasury Department had no valid reason to refuse it,” the outlet added.

However, the dynamic has changed given Republicans narrowly won control of the U.S. House in the next Congress.

That means that Republicans can — and will likely — scrap the Ways and Means Committee’s investigation.

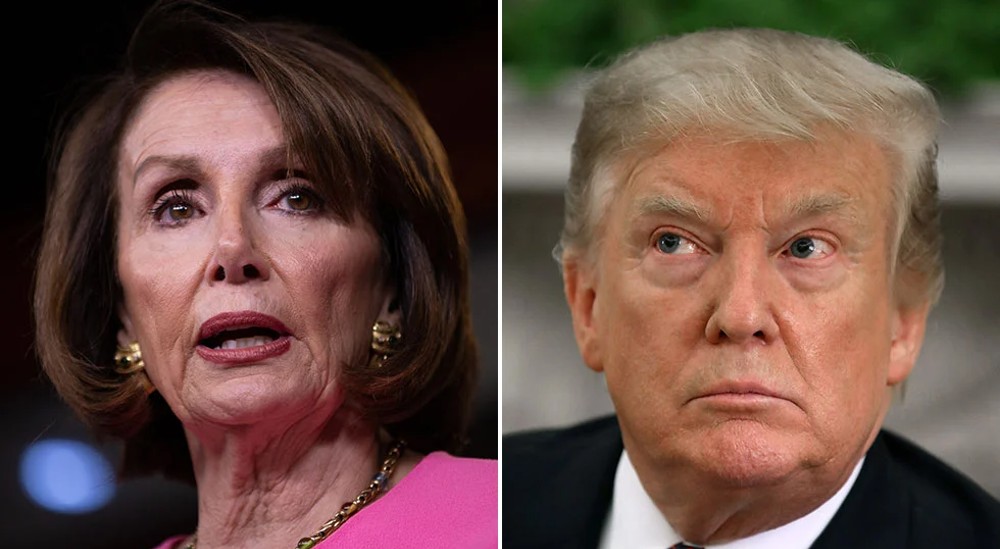

House Speaker Nancy Pelosi released a statement on the decision, saying: “The House looks forward to promptly receiving and reviewing these documents. These documents are vital to meeting the House’s Constitutional mandate: guarding the public interest, defending our national security, and holding our public officials to account. Congress must enact legislation requiring Presidents and candidates for President to disclose their tax returns.”

Earlier this month, Supreme Court Chief Justice John Roberts ruled in favor of Trump in his appeal to keep his tax returns from Congress.

“Chief Justice John Roberts agreed to temporarily put on hold a lower court order requiring the release of former President Donald Trump’s tax returns by the Internal Revenue Service to a Democratic-led House committee,” CNN reported.

Democrats have been fighting to get Trump’s tax returns for years.

Last December, a federal judge rejected Trump’s lawsuit to shield his tax returns from congressional Democrats.

U.S. District Court Judge Trevor McFadden, a Trump appointee, dismissed the case, citing Supreme Court precedent. McFadden said Trump was “wrong on the law” and that Congress is due “great deference” in its inquiries.

“Even the special solicitude accorded former Presidents does not alter the outcome,” McFadden wrote in a 45-page ruling. “The Court will therefore dismiss this case. Even if the former President is right on the facts, he is wrong on the law,” McFadden said. “A long line of Supreme Court cases requires great deference to facially valid congressional inquiries.”

McFadden did suggest that Rep. Neal should refrain from making Trump’s tax information public, though he noted it was the “chairman’s right to do so.”

“Anyone can see that publishing confidential tax information of a political rival is the type of move that will return to plague the inventor,” the judge wrote. “It might not be right or wise to publish the returns, but it is the Chairman’s right to do so. Congress has granted him this extraordinary power, and courts are loath to second-guess congressional motives or duly enacted statutes. The Court will not do so here and thus must dismiss this case.”

“Ultimately, though, these statements are irrelevant to the Court’s analysis,” McFadden wrote. [T]he Supreme Court’s precedents analyze whether Congress has a valid legislative purpose, not whether that is the only purpose.”

“The Court agrees with the Federal Parties that returns from those other years could further the Committee’s study of the Program,” McFadden ruled. “Like an audit of any other taxpayer, a presidential audit can extend beyond a current return to “related returns” from other years.”

After President Joe Biden took office, the Department of Justice reversed course and claimed there are “sufficient reasons” for the Democrat panel to see the material.