OPINION: This article may contain commentary which reflects the author's opinion.

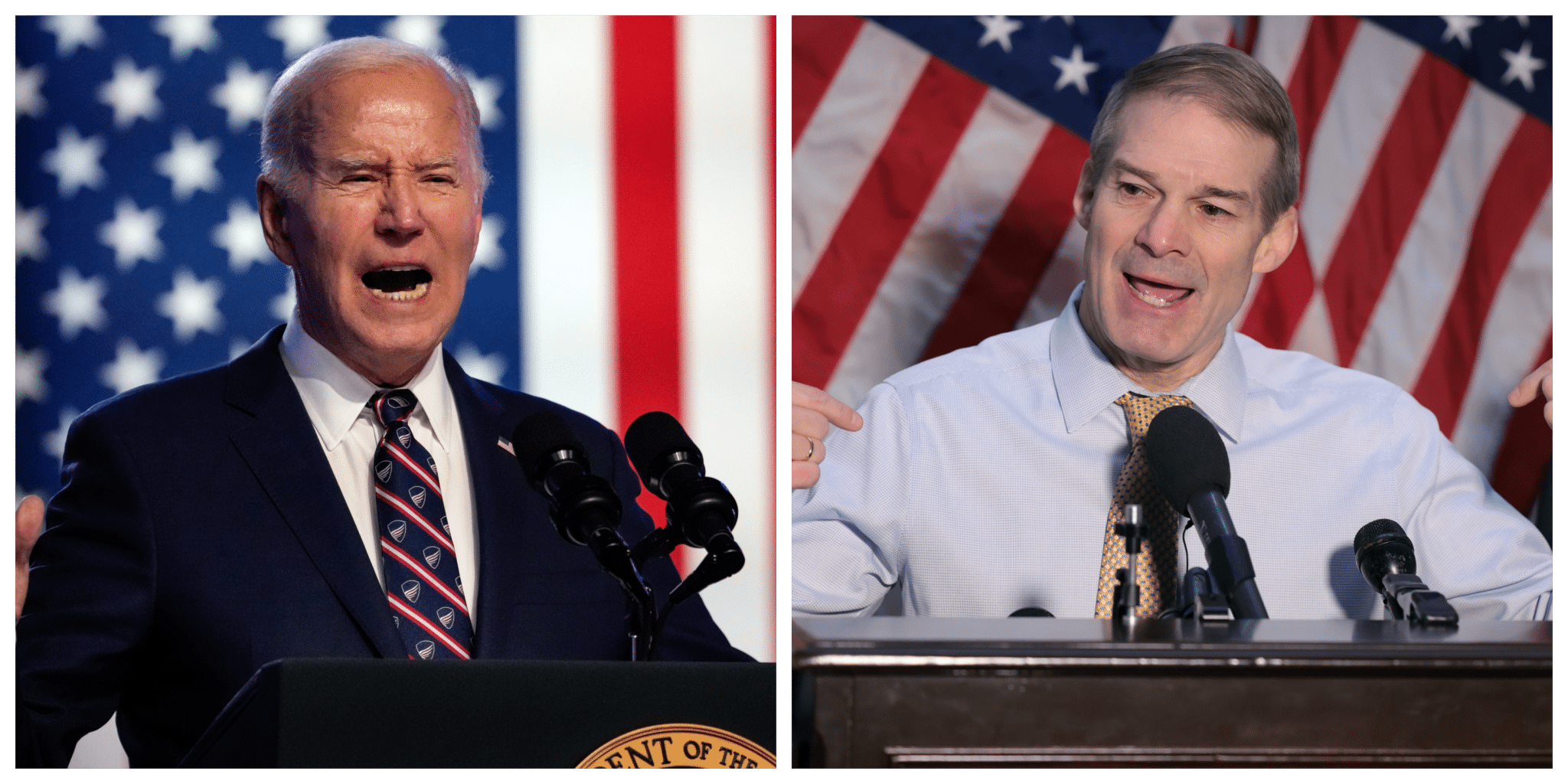

House Judiciary Committee Chairman Jim Jordan (R-Ohio) cheered the decision by some of America’s and the world’s biggest financial institutions to abandon a $68 trillion climate alliance that was founded by the United Nations and backed by the Biden administration.

In a surprising turn of events on Thursday, JPMorgan Chase, the world’s largest bank, and State Street Global Advisors, an institutional investor overseeing $3.5 trillion in assets, announced their withdrawal from the Climate Action 100+ investor group. Also, BlackRock, which is managing over $10 trillion in assets, significantly reduced its participation in the alliance, Fox News reported exclusively.

“This is great news because you’re supposed to make investment decisions based on just good common business sense, your fiduciary responsibility to your investors, not based on left-wing woke politics,” Jordan told Fox News Digital. “So, yeah, this is a win for America, a win for the economy, a win for Americans and investors and, more importantly, it’s a win for freedom.”

“The folks who are involved in these banks are smart people, successful people. They’ve done well. I think deep down they know decisions should be based on the market, on principles of capitalism, not on politics,” he added.

Under Jordan’s leadership, the House Judiciary Committee initiated an extensive investigation into what he termed the “climate-obsessed corporate ‘cartel'” in December 2022, coinciding with Republicans’ impending takeover of the chamber. The primary focus of the panel has been to examine whether the financial sector, with the assistance of nonprofit activist climate groups, is infringing upon U.S. antitrust laws.

The Biden administration has prioritized ‘climate change’ policy, such as pushing electric vehicles and enacting measures that many believe are harmful to the country’s national and economic security.

Fox added:

As part of the initial effort, Jordan and several fellow House Republicans penned a letter to the Steering Committee for Climate Action 100+, demanding information about the coalition’s network of influence. The letter stated that the alliance “seems to work like a cartel to ‘ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change.’”

Since then, Jordan’s committee has expanded the investigation, firing off inquiries into BlackRock, State Street and Vanguard, in addition to nonprofits Glasgow Financial Alliance for Net Zero and the Net Zero Asset Managers initiative. And late last year he issued subpoenas to BlackRock and State Street, compelling the production of documents related to his investigation into potential antitrust violations.

“I think we’ve done more subpoenas and more interviews and written more letters than probably most of the rest of Congress combined,” Jordan told Fox News.

“We have been pushing for stopping this kind of coordination and collusion that we think is harmful to the economy, to freedom, to investors,” the Judiciary Committee chair noted further. “So, you know, we’re just doing our job, and we’re happy to see that three huge banks — the decision they made today, and I think, as I said before, it’s a win for the country.”

Climate Action 100+ was officially launched in December 2017 at the United Nations with the aim of coordinating efforts among the world’s largest private-sector financiers to address greenhouse gas emissions. Since its inception, the initiative has expanded to encompass over 700 financial institutions, collectively managing a staggering $68 trillion in assets.

The group, managed by a nongovernmental steering committee composed of ESG activists, advocates for its members to interact with companies on “improving climate change governance,” reducing carbon emissions, and reinforcing climate-related financial disclosure policies. Its initiatives primarily target investments favoring the oil and gas sector while promoting strategies that support green energy investment.

However, in June 2023, Climate Action 100+ introduced its “phase 2” strategy, urging member investors to actively collaborate with companies to diminish their carbon footprint. The forthcoming initiative raised concerns at State Street and BlackRock.

“After careful review, State Street Global Advisors has concluded the enhanced Climate Action 100+ Phase 2 requirements for signatories will not be consistent with our independent approach to proxy voting and portfolio company engagement,” State Street Global Advisors said in a statement to Fox News. “As a result, we have decided to withdraw from Climate Action 100+.”

The outlet said BlackRock issued a similar statement.

“This new strategy will require signatories to make an overarching commitment to use client assets to pursue emissions reductions in investee companies through stewardship engagement,” the firm stated. “In our judgment, making this new commitment across our assets under management would raise legal considerations, particularly in the U.S.”