OPINION: This article may contain commentary which reflects the author's opinion.

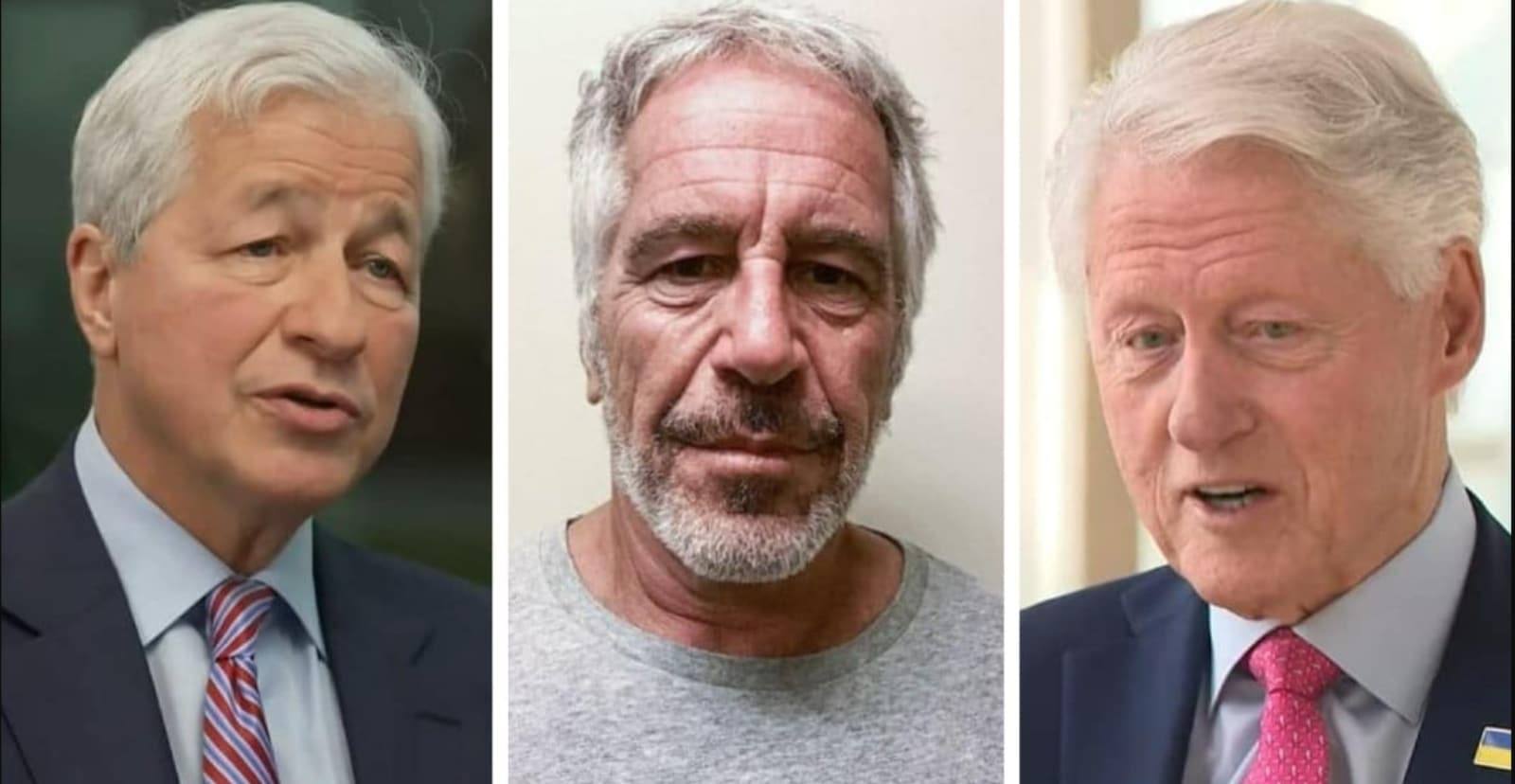

The CEO of JPMorgan Chase, Jamie Dimon sat for depositions related to a pair of lawsuits linked to regarding late financier and convicted child sex trafficker Jeffrey Epstein.

His testimony came as the U.S. Virgin Islands and the banking giant traded allegations over who was the biggest enabler of Epstein’s sex trafficking of minor girls, Fox Business Network reported.

JPMorgan Chase said Dimon “stated in a deposition Friday that he never met or communicated with Epstein, who was the bank’s client from 2000 to 2013, Reuters reported. Epstein remained a JPMorgan client after pleading guilty in 2008 to a Florida state prostitution charge,” the outlet reported.

Dimon’s testimony was an important milestone in a lawsuit first filed by U.S. Virginia Islands Attorney General Denise George in December, where she alleged that JPMorgan “turned a blind eye to evidence of human trafficking over more than a decade because of Epstein’s own financial footprint, and because of the deals and clients that Epstein brought and promised to bring to the bank.”

The lawsuit claims JPMorgan “knowingly facilitated, sustained, and concealed the human trafficking network” operated by Epstein while also reaping financial benefits from their involvement. It alleges that the bank knowingly failed to comply with federal banking regulations in relation to Epstein’s activities, which were centered in the Virgin Islands, the outlet continued.

“These decisions were advocated and approved at the senior levels of JPMorgan, including by the former chief executive of its asset management division and investment bank, whose inappropriate relationship with Epstein should have been evident to the bank. Indeed, it was only after Epstein’s death that JPMorgan belatedly complied with federal banking regulations regarding Epstein’s accounts,” the complaint states, the outlet reported.

In its response to the litigation, JPMorgan asserted that it was actually the top officials of the U.S. Virgin Islands who had purportedly accepted monetary payments, favors, and influence from Epstein. The bank further claimed that those officials turned a blind eye to and facilitated Epstein’s sex trafficking operation in exchange for various benefits.

The bank claimed that Cecile de Jongh, the wife of former USVI Gov. John de Jongh, was Epstein’s “primary conduit for spreading money and influence throughout the USVI government,” adding that she “explicitly advised Epstein on how to buy control of the USVI political class.”

The bank’s filing also alleges that she had even sent an email to Epstein, seeking his input on the draft of the territory’s sex offender law. Furthermore, the filing claims that de Jongh arranged flights and assisted in obtaining school and work visas for Epstein’s victims.

According to the bank’s filing, the former first lady purportedly received a total of $200,000 in 2007 alone.

“USVI protected Epstein, fostering the perfect conditions for Epstein’s criminal conduct to continue undetected. Rather than stop him, they helped him,” the bank’s filing said. “In sum, in exchange for Epstein’s cash and gifts, USVI made life easy for him. The government mitigated any burdens from his sex offender status. And it made sure that no one asked too many questions about his transport and keeping of young girls on his island.”

“At today’s deposition, our CEO repeatedly confirmed that he never met with him, never emailed him, does not recall ever discussing his accounts internally, and was not involved in any decisions about his account,” JPMorgan said in a statement Friday, as per Reuters.

The bank further argued that the “millions and millions of emails and other documents that have been produced in this case” do not approach the level of “even suggesting that he had any role in decisions about Epstein’s accounts.”

Dimon is not suspected of any wrongdoing in the lawsuits, but a federal judge told him to set aside four days last week for depositions.