OPINION: This article may contain commentary which reflects the author's opinion.

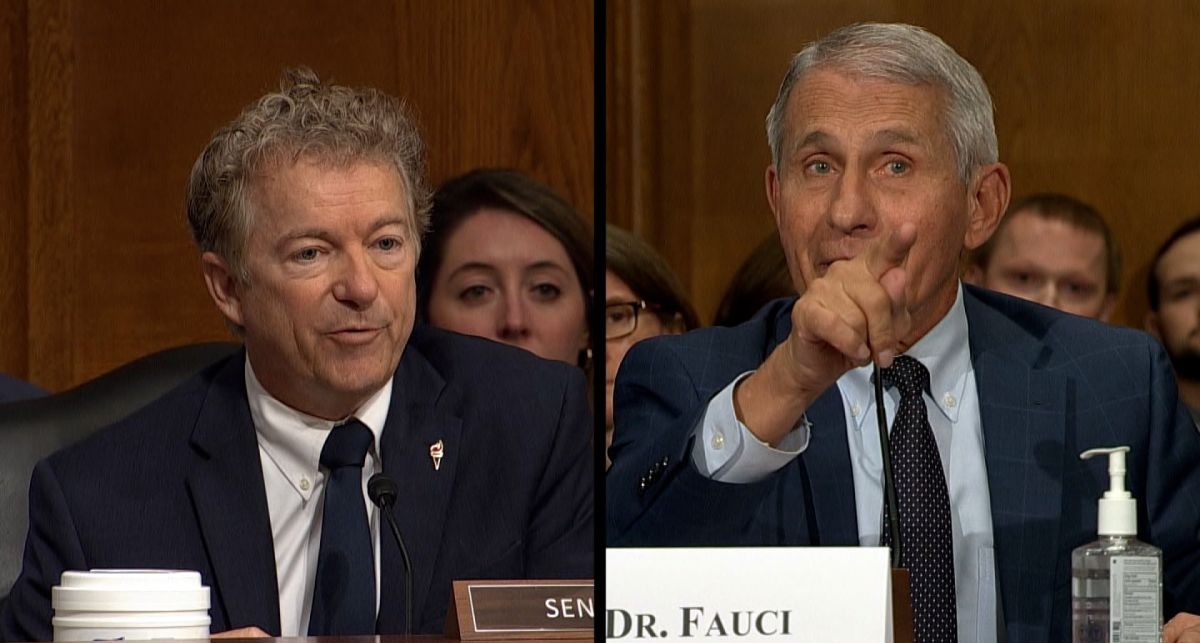

Kentucky GOP Sen. Rand Paul and Dr. Anthony Fauci got into another heated exchange over the origins and response to the COVID-19 pandemic.

During a virtual appearance before the U.S. Senate, Fauci was asked a slew of questions about the pandemic and his decisions stemming over the last three years.

In particular, Paul asked Fauci about the approval justification for booster shots for children over 5 years old.

“Are there any studies that show a reduction in hospitalization or death for children that take a booster?” Fauci asked.

“No,” Fauci said, leading Paul to respond: “Then why is the government recommending it?”

Fauci testified remotely to the Senate Health Committee after testing positive for coronavirus.

When the senator responded by demanding Fauci provide documents on his royalty income, the doctor lost his patience.

“Are you going to let me answer a question? Soundbite number one?” he said.

WATCH:

Paul recently released a damning report on rising inflation and its troubling effects on low and middle-income families and small businesses.

In an 18-page report called “The Hidden Tax,” Paul, who serves on the Senate Committee on Small Business and Entrepreneurship, blames the 7% spike in consumer prices – a 40-year high – on “excessive coronavirus relief spending by Congress.”

Paul is also warning that the rising prices are “only going to get worse.”

“In recent months, prices on nearly everything from gas, food, and clothes to electricity, car prices, and rent, have all increased, and unfortunately it’s only going to get worse,” Paul said in a statement. “Congress needs to realize that further spending at this time of rapidly rising prices is only going to continue the trend of rising prices on this nation’s already vulnerable businesses and families.”

“The Hidden Tax” report details how prices on everyday essential goods have dramatically increased in the last year since Joe Biden took office.

“$4.9 trillion in COVID-19 stimulus spending has led to one of the highest and sustained levels of inflation in U.S. history,” Paul said.

“Though government stimulus spending was intended as a form of relief, and low and middle-income families, as well as small business owners, were promised that their taxes would not increase as a result of these packages, Americans are now paying a ‘hidden tax’ for these policies,” he added.

Below are some of the topline figures from Paul’s report:

–The cost of an average tank of gas rose from $25.32 in December 2020, to $38.04 in December 2021.8 A used car that cost $10,000 in December 2020, cost $13,730 in December 2021. A grocery cart that cost $100 in December

2020, cost $106.30 in December 2021.9

–While these price increases may seem trivial to wealthy families, this disproportionately burdens low and middle-income families that spend a much larger portion of their income on

these items.

–71 percent of households making under $40,000 annually have indicated economic hardships from rising prices, as opposed to just 29 percent of households making $100,000 or more.

–Inflation disproportionately harms small businesses. 82 percent of small businesses reported rising prices in the last several months, 42 percent reported raising prices by 20 percent or more. 45 percent of small businesses reported taking out a loan to cope with the pressures of inflation in this last year. Large corporations have reported consistent profit margins.

–In 2021, energy prices as a whole, including electricity, propane, gasoline, and other energy sources, rose 29.3 percent. Gasoline on its own rose 49.6 percent. For perspective, a tank of gas for the average American in November of 2020 cost $25.32. The same tank of gas in November of 2021 cost the average American $38.04.

–This trend is even more shocking considering Americans drove considerably less in 2020 and 2021 than in previous years.20 Aside from the jump in energy prices, used vehicle prices and food have also been key contributors to the price jumps, rising 37.3 percent and 6.3 percent respectively.

–Rising prices also disproportionately burden low and middle-income families. A recent poll by Gallup has shown disparities between both income and education level in the amount of hardship reported from recent inflation trends. 70 percent of those earning under $40,000 annually reported moderate or severe hardship as a result of inflated prices in the last year compared to 28 percent of those earning over $100,000 annually.