OPINION: This article may contain commentary which reflects the author's opinion.

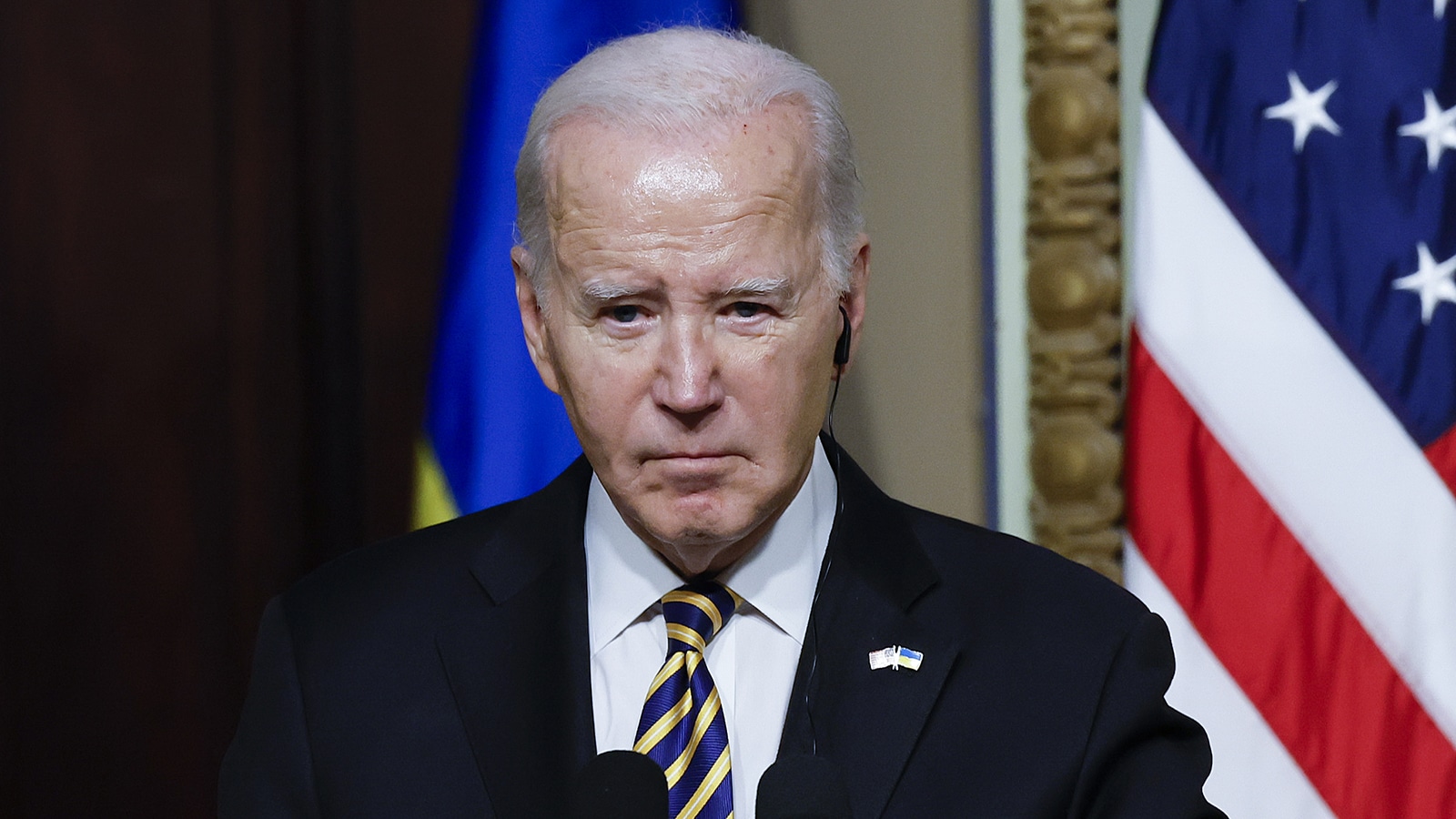

President Joe Biden has based a good portion of his campaign on his economic policies — collectively known as “Bidenomics” — but it appears they are coming back to bite him.

A new report on homelessness shows that the number of homeless Americans has surged 12 percent in one year, a record, The Washington Post reported.

The Department of Housing and Urban Development issued its snapshot report last week, and it showed that more than 650,000 people were experiencing homelessness for a minimum of the one night it was surveyed in January.

It is a 12 percent increase from the snapshot of 2022 and the highest since the report began in 2007.

“Homelessness should not exist in the United States,” HUD Secretary Marcia Fudge said on X, formerly Twitter.

“The data released today underscores the urgent need for support for proven solutions and strategies that help people quickly exit homelessness and that prevent homelessness in the first place,” she said.

When examined by race, Asian Americans were the most affected, with a 40 percent representation in homelessness, while black Americans were 37 percent and Hispanics came in at 33 percent.

“The most significant causes are the shortage of affordable homes and the high cost of housing that have left many Americans living paycheck to paycheck and one crisis away from homelessness,” Jeff Olivet, executive director of the U.S. Interagency Council on Homelessness, said.

California, New York, Washington, and Florida account for the largest populations of homeless individuals in the report.

The Washington Post added: The numbers recorded in the annual one-night count are a stark undercount of all people experiencing homelessness, so they cannot be used as a census, said Donald Whitehead, executive director of the National Coalition for the Homeless.

“You want to think of this as useful and a report that drives action,” he told The Washington Post. “It is a way to plan, it’s a way to look at trends.”

The covid-era funds, distributed through the American Rescue Plan Act, allowed for “significant innovations,” including sheltering people in hotels and converting temporary spaces into permanent housing, said Whitehead, who was one of the HUD report’s reviewers.

Biden has been touting his Bidenomics plan and insisting that his economic policies have made the lives of Americans better.

But what they are telling pollsters is that Bidenomics has caused them to spend less this Christmas season and, in many cases, has them working more hours or working another job simply to afford the holidays.

In the survey, Empower’s 2023 holiday spending report, a whopping 74 percent of the 1,000 people polled said that inflation has caused them to spend less this holiday season, and 31 percent said they are working more hours to afford it, Fox Business reported.

“The survey shows that over a third (34%) are trimming their budgets in favor of saving this year, while others are cutting back on buying gifts or non-essential expenses like dining out to stay on track,” Empower representative Courtney Burrell said to Fox Business.

“How you allocate your holiday budget will depend on what’s most important to you – this year, you may prioritize travel to visit family that you typically only see during the holidays over decorations or cut back on social commitments in order to give yourself a larger budget for holiday gifts,” she said.

“Thirty-seven percent of respondents said they plan to spend less than $250 on gifts this year, and more than one in 10 told Empower they are budgeting more than $1,000,” the report said.

Still, numbers show that people are spending this holiday season as shopping over the Thanksgiving weekend broke records, and holiday shopping in general is expected to break records.

“However, the spending spree comes as U.S. consumers are already carrying record levels of credit card debt, and some experts are concerned a potential crisis is brewing as the balances rack up, and more people find themselves unable to pay them back – especially at today’s high interest rates,” Fox Business said.