OPINION: This article may contain commentary which reflects the author's opinion.

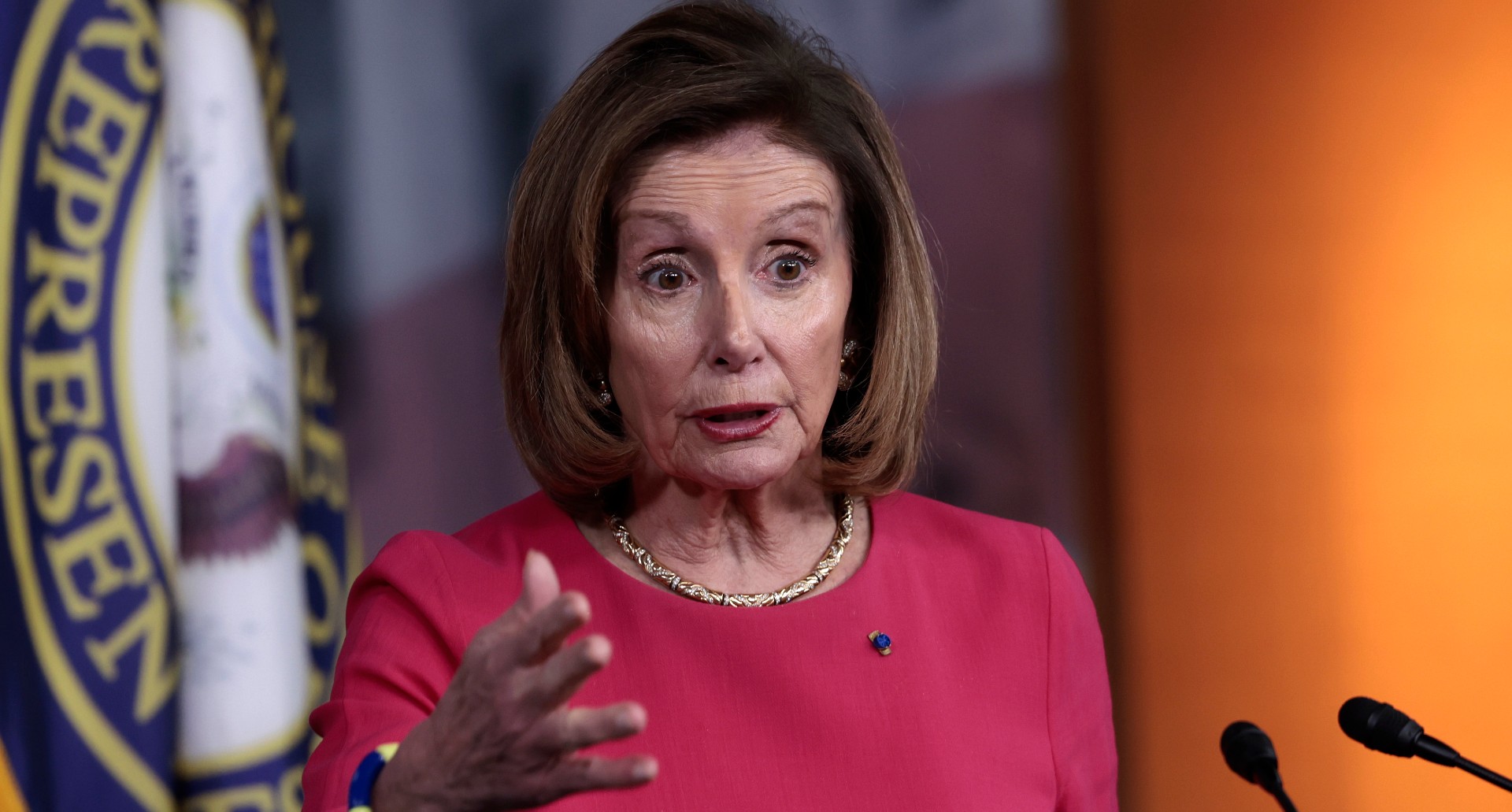

Former House Speaker Nancy Pelosi has turned heads again with what critics say is a conveniently timed stock sale, leading to new calls for a law that prohibits members of Congress from most trading while in office.

Prior to the November midterms, then-House Minority Leader Kevin McCarthy (R-Calif.) pledged to scrutinize trades and sales made by the California Democrat and her husband, Paul Pelosi, after several of them appeared to coincide with legislation making its way through Congress, leading to allegations of insider trading.

A sale that Nancy Pelosi disclosed in late December appears to have reenergized Republicans who want to crack down on the practice as a matter of restoring some faith in the institution. According to a congressional disclosure form, she sold around 30,000 shares of Google stock roughly three weeks before the Justice Department and eight states announced an anti-trust lawsuit against Alphabet, which is Google’s parent company.

Source of article & source of the sellhttps://t.co/zvweRQyLo0 pic.twitter.com/Vx4KYKERMu

— Nancy Pelosi Stock Tracker ♟ (@PelosiTracker_) January 25, 2023

“This latest action comes more than two years after the agency and a group of state attorneys general joined in another suit alleging Google’s search and search advertising businesses violate U.S. antitrust laws,” Yahoo! Finance reported Wednesday, adding:

The Justice Department’s [complaint] alleges that Google’s suite of online advertising tools prevents competitors from entering the online advertising market and blocks publishers from monetizing their own content.

The department further claims that Google is illegally using, or trying to use, its monopoly power, and should be required to divest a host of entities that allow it to carry out the allegedly offending behavior.

An accompanying Justice Department complaint lays out the allegations.

“Google’s anticompetitive behavior has raised barriers to entry to artificially high levels, forced key competitors to abandon the market for ad tech tools, dissuaded potential competitors from joining the market, and left Google’s few remaining competitors marginalized and unfairly disadvantaged,” the complaint states.

“Google has thwarted meaningful competition and deterred innovation in the digital advertising industry, taken supra-competitive profits for itself, and prevented the free market from functioning fairly to support the interests of the advertisers and publishers who make today’s powerful internet possible,” it added.

Per The Daily Wire:

Pelosi, who resigned from her leadership position but remains a member of Congress, sold 10,000 shares of Alphabet Class A stock on December 20, December 21, and December 28, according to federal disclosures, marking a combined transaction value between $1.5 million and $3 million. The disclosures were digitally signed by the lawmaker on January 12.

Pelosi’s most recent trade just ahead of a major lawsuit “adds more fuel to the fire behind her and her husband Paul’s long record of alleged leverage of insider knowledge,” Big League Politics noted.

For instance, as the Daily Wire reported, “Paul Pelosi appeared to have cut losses in software company Nvidia last year before the United States placed new restrictions on computer chip sales to China and Russia.”

Another example relayed by The Hill added: “In March 2021, Paul Pelosi exercised options to purchase 25,000 Microsoft shares worth more than $5 million.”

“Less than two weeks later, the U.S. Army disclosed a $21.9 billion deal to buy augmented reality headsets from Microsoft. Shares of the company rose sharply after the deal was announced,” the outlet added.

In August, McCarthy expressed concern over Paul Pelosi having tremendous success in picking the correct stocks to purchase and sell and recently purchased large shares of NVIDIA prior to the House and Senate passing legislation that benefited the company.

“I would look all the way through it,” he said of the Democrat proposal to ban stock trading for spouses of Congress members. “What I’ve told everybody is we will come back, and we will not only investigate this, we will come back with a proposal to change the current behavior.”

“Her husband can trade all the way through, but now it becomes a crisis?” he said. “I think what her husband did was wrong.”

“I think we need to bring trust back to this institution,” he said. “I think we have to do a thorough investigation and look at what is the proper role for members of Congress and what influence they have, and I don’t think the proper way to do this is Nancy Pelosi writing the bill because we have proven that she can’t do that.”