OPINION: This article may contain commentary which reflects the author's opinion.

Shark Tank star and investor Kevin O’Leary said that former President Donald Trump’s $350 million-plus fraud ruling is making him rethink investing in the “mega loser state” of New York.

“I’m not different than any other investor. I’m shocked at this. I can’t even understand or fathom the decision at all. There’s no rationale for it,” O’Leary said during an interview on Fox Business Network’s “Cavuto Coast To Coast.”

“It does not matter what the governor says. New York was already a loser state, like California is a loser state there are many loser states because of policy, high taxes, uncompetitive regulation it was already on the top of the list to be the loser state. I would never invest in New York now. I’m not the only person saying that,” O’Leary said.

“That is why New Yorkers should be concerned. The fine people of New York should ask themselves why are we a loser state? How are we going to attract business? It is not just the existing businesses moving to Texas and Florida, what about new money that I’m talking about like a 4 billion-dollar data center? Not a chance I would put that in New York,” O’Leary added.

He concluded, “They have a lot of work to do to find themselves getting out of the situation and this has occurred post pandemic. It’s winner versus loser states, look at Tennessee the fastest growing city in Nashville, good policy, competitive taxes. You gotta start thinking about this in the context of winners and losers. New York is a mega loser state.”

WATCH:

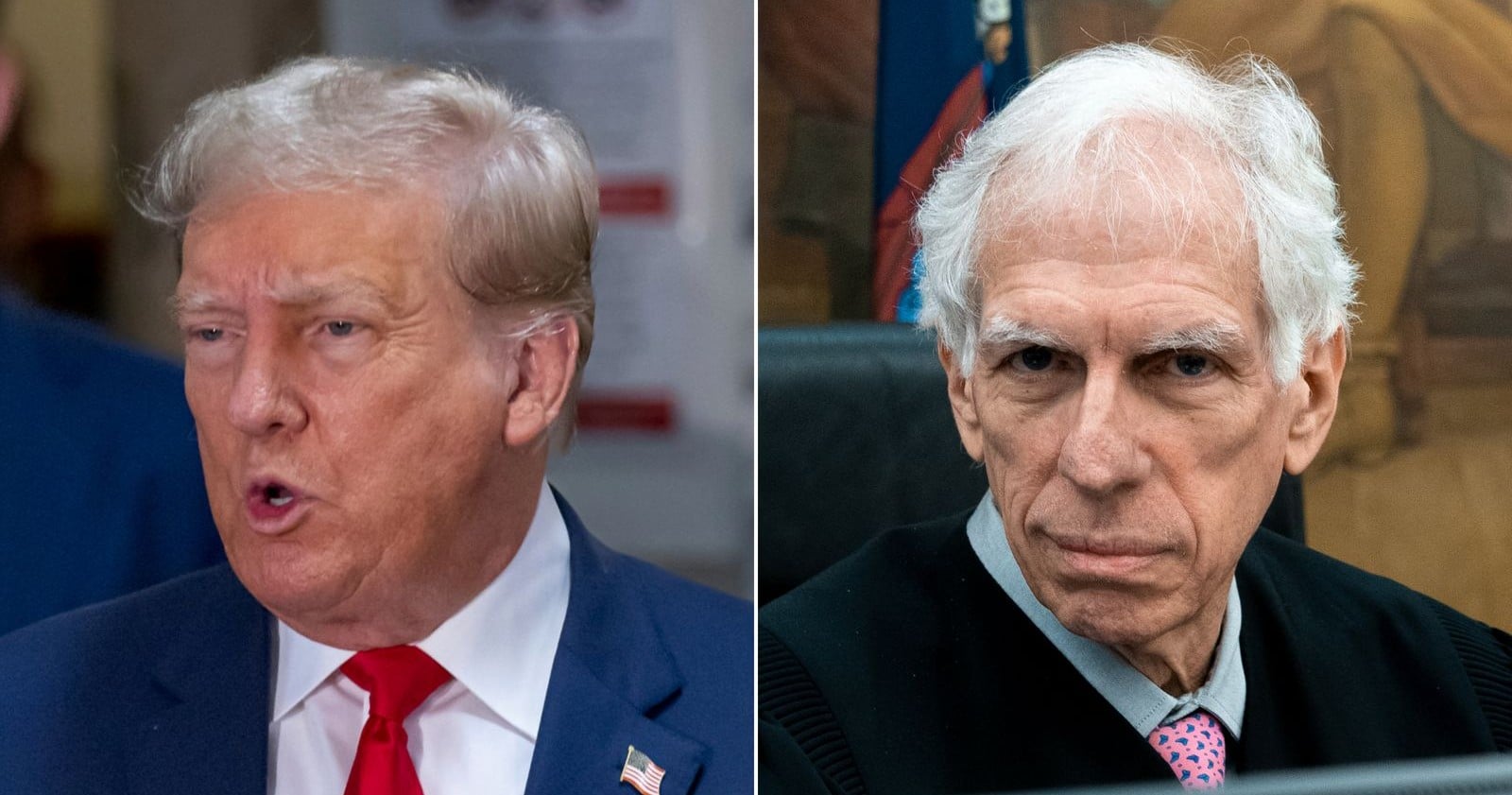

Trump will challenge Judge Arthur Engoron’s definition of fraud that led to a $355 million judgment in the former president’s New York civil trial.

Chris Kise, Trump’s lead attorney in the case, told Newsweek that it “will depend on many factors, so it’s hard to say at the moment, but in any event, it will fall within the 30-day clock” that the court permits.

Kise accused New York Attorney General Letitia James and Engoron of trying to force Trump out of New York, calling it a sad day for the city.

“The case raises serious legal and constitutional questions regarding ‘fraud’ claims/findings without any actual fraud,” Kise said.

In September 2022, James filed a lawsuit against Trump, his two adult sons, Donald Jr. and Eric, the Trump Organization, and two firm executives, Allen Weisselberg and Jeff McConney.

Engoron, who oversaw the trial, discovered that Trump had inflated his assets to obtain more advantageous business loans.

A trial was held from late last year into early January to determine the amount of damages that the former president and his associates would have to pay.

Engoron issued a decision on February 16 stating that Donald Trump would have to pay a fine of about $355 million.

Trump, Weisselberg, and McConney are prohibited from serving as officers or directors of any New York corporation for three years.

Donald Trump Jr. and Eric Trump must pay over $4 million each and cannot conduct any business in the state for 2 years. Trump denies any wrongdoing and calls the case politically motivated.

The appeal of the case depends on the definition of fraud used in the proceedings.

Greg Germain, a professor at the Syracuse University of Law, told Newsweek that on appeal, Trump will need to prove the New ork AG does not possess the power to punish him “without showing the traditional elements of fraud: (1) scienter—intent to defraud, (2) false statements of fact rather than opinion or trade puffing, (3) reasonable reliance by the victims, (4) materiality, (5) causation, and (6) damages.”

James’ team argues that they don’t need to prove all six elements under New York’s Executive Order 63.12.

The order allows the prosecution of fraud with civil allegations and subpoenas.

A banking official testified that they didn’t solely rely on Trump’s statements for a loan application.